maryland local earned income tax credit

The Social Security Administration bases work credits on your total yearly wages or self. Those who qualify based on particular thresholds are entitled to a credit on the State return that may equal up to 50 of the federal credit and can.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

MORE SUPPORT FOR UNEMPLOYED MARYLANDERS.

. The legislation expands the credit to an estimated 60000 low-income Marylanders who file. You must first have worked in jobs covered by Social Security in order to be eligible to apply for Social Security disability benefits. It is important to note that Montgomery County is the only C ounty in Maryland that offers a local income tax credit for its residents with a 100 match of the State earned income credit for the applicable tax year.

The Federal Earned Income Tax Credit which is aimed at people in the lowest-paid jobs is being tripled for a group of workers who typically dont benefit much from it. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years. Ii Primary Staff for This Report.

The chart shown below outlining the 2020 Maryland income tax rates and brackets is for illustrative purposes only. Some taxpayers may even qualify for a refundable Maryland EITC. Some taxpayers may even qualify for a refundable Maryland EITC.

Get Your Max Refund Today. 2016 Maryland Earned Income Tax Credit EITC Marylands El TC is a credit for certain taxpayers who have income and have worked. The state EITC reduces the amount of Maryland tax you owe.

Find the state to which you paid a nonresident tax in Group I II or III. Income below a certain amount. STATE AND LOCAL TAX CREDIT FOR INCOME TAXES PAID TO OTHER STATES If you are a Maryland resident including a resident fiduciary and you paid income tax to another state you may be eligible for a State and local tax credit on your Maryland return.

Thestate EITCreducesthe amount of Maryland tax you owe. 2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The local EITC reduces the amount of county tax you owe.

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Families may also be eligible for other credits such as the earned income tax credit. The income limit is 56844 for married couples who file jointly with three or more qualifying children.

The state EITC reduces the amount of Maryland tax you owe. Thelocal EITC reduces the amount of county tax you owe. The state EITC reduces the amount of Maryland tax you owe.

The local EITC reduces the amount of county tax you owe. The expanded tax credit will arrive. Marylands EITC is a credit for certain taxpayers who have income and have worked.

The local EITC reduces the amount of county tax you owe. Some taxpayers may even qualify for a refundable Maryland EITC. The local El TC reduces the amount of county tax you owe.

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. If you claimed an earned income credit on your federal return or would otherwise have been eligible to claim an earned income credit on your federal return but for you or your spouse filing with an individual taxpayer identification number ITIN and if you have at least. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

Some taxpayers may even qualify for a refundable Maryland EITC. Maryland is extending the filing and payment deadline for individual income taxes until July 15 to help families struggling financially due to the pandemic Comptroller Peter Franchot announced. In Maryland stimulus checks have begun going out to lower-income people who are US.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. 2 days agoIn the first year of employment employers can claim a credit equal to 40 of the first 6000 of wages paid to an employee who is among the groups targeted for employment opportunities. The state EITC reduces the amount of Maryland tax you owe.

Taxpayers can go to a federal site childtaxcreditgov to find a. Some taxpayers may even qualify for a refundable Maryland EITC. The tax credit can reduce the amount of taxes a resident owes or it can provide a refund.

The Maryland earned income tax credit EITC will either reduce or. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. For the tax year that just ended low-income workers without kids can receive a credit worth up to 1500 nearly triple what the credit was worth in 2020.

2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. 33 rows If you qualify for the federal EITC see if you qualify for a state or local. If the State nonrefundable credit reduces a taxpayers liability to zero the taxpayer is eligible to claim a State refundable credit.

Updated on 4152021 to include changes for Relief Act 2021. New Issue Report Fri 12 Jun 2009. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

State Earned Income Credits Maryland offers a nonrefundable credit which is equal to the lesser of 50 of the federal credit or the State income tax liability in the taxable year.

Maryland Tax Forms 2021 Printable State Md Form 502 And Md Form 502 Instructions

How Does The Deduction For State And Local Taxes Work Tax Policy Center

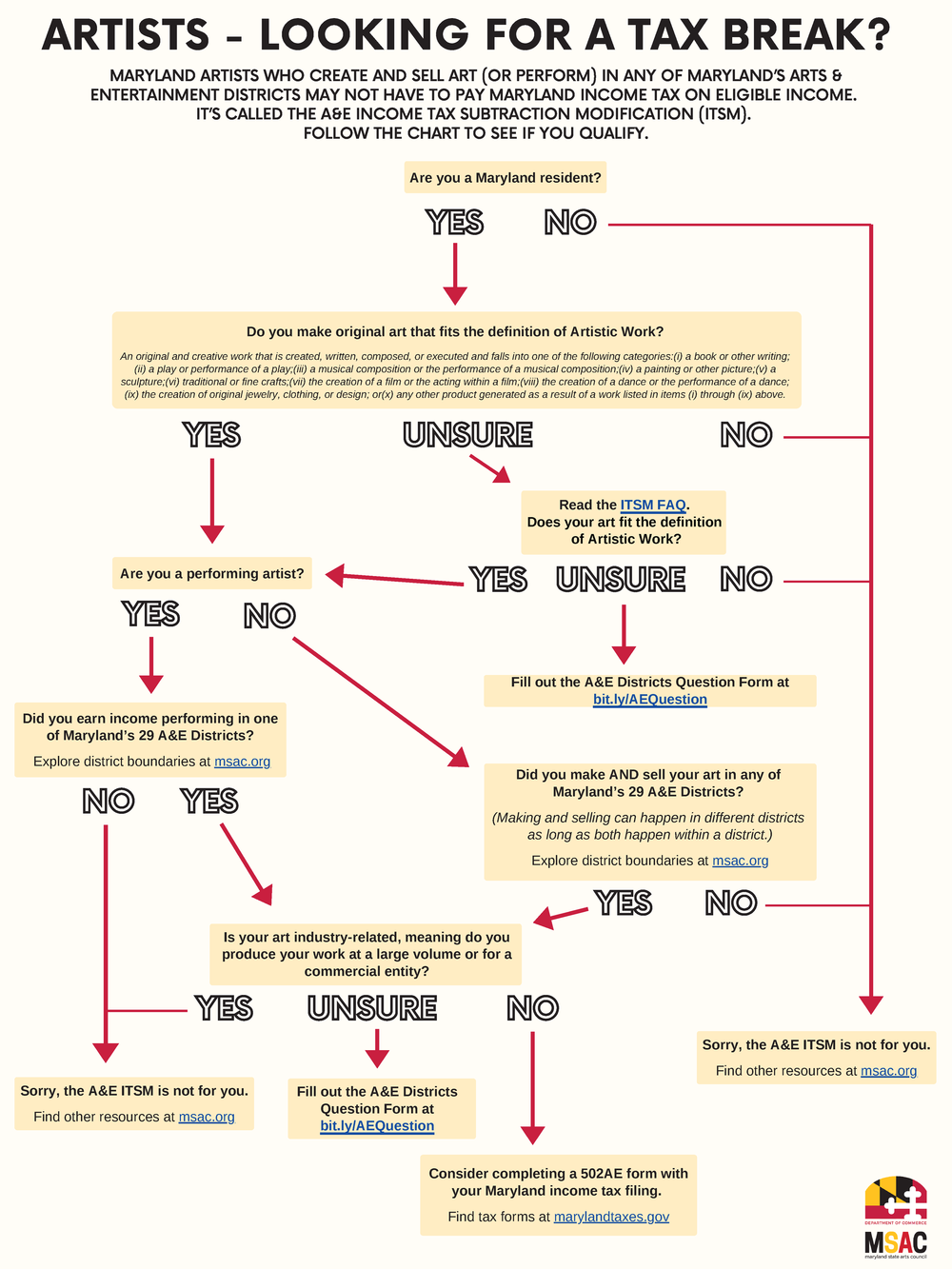

Tax Credit Station North Arts District

How Do State And Local Individual Income Taxes Work Tax Policy Center

Maryland Refundwhere S My Refund Maryland H R Block